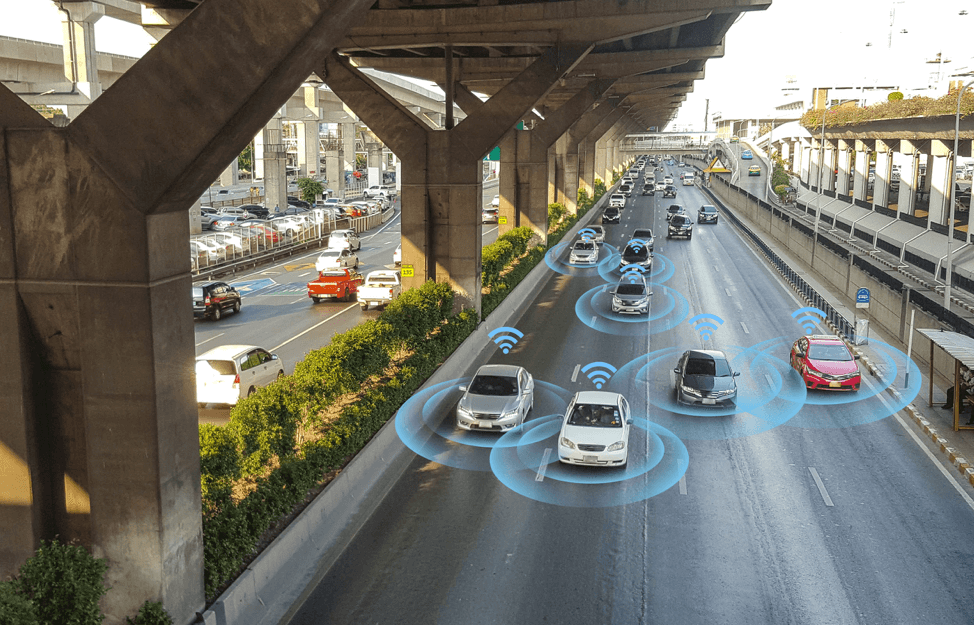

Self-driving cars are riding into reality as companies such as GM, Tesla, and ride sharing businesses like Uber and Lyft have put them on the roads. As developers have pitched these to reduce accidents, concerns are beginning to be raised.

In May 2016, a CNBC reported that a Tesla Model S collided with an 18-wheeler in Florida, killing the owner, while in 2018, one crashed into a firetruck in Los Angeles. What if you were injured in an autonomous car accident? Who would you file a claim against and how would the insurance company handle it?

Get a car accident lawsuit advance to cover your medical expenses, rent, household bills, and more while your case or settlement is pending. Lawsuit Cash 24/7 can approve you for car accident fundingin less than 24 hours, with no hidden fees — apply nowor call toll-free at (866) 321-7720 today!

Ways autonomous technology may affect auto accident claims and the insurance

industry:

- Automakers Will Be Liable for Accidents and Damages – If a human driver wasn’t in control at the time of an accident, the manufacturer may assume liability. It has happened already. Companies such as Google and Volvo have accepted liability for faults in self-driving systems that led to crashes. Individual drivers must purchase insurance now, but insurance companies may start to sell policies to manufacturers, so policy costs may someday be included in the price of a car. Tesla has already extended an insurance program to customers who purchase its self-driving vehicles.

- The Way Claims Are Investigated May Change –

There are few legal precedents to consider today. More litigation is sure to

take place, but investigating self-driving car accidents will likely require a

different approach. Automotive accident attorneys will need to look at data

from sensors that track whether a human driver or a vehicle’s autonomous system

was in control at the time of an accident. Only if the person in the car wasn’t

in control would an automaker be fully liable.

- Drivers May Reduce or Drop Insurance Coverage –

If limited coverage becomes more commonplace, filing a claim may become more

challenging. Who will pay for damages if one does not have personal auto

insurance? And if enough drivers reduce or drop their coverage, the insurance

industry may struggle, while industry insiders have speculated about a drop in

state mandatory coverage requirements. Insurance companies may need to change

their business models and consumers may need to consider their priorities when

it comes to protecting themselves.

- You May Need to Increase Insurance Limits – A

vehicle with advanced technology can incur more expensive damage, even in a

minor collision. That means you’d need higher auto insurance limits as the

owner of an autonomous vehicle. But if you cause an accident with one, the

insurance claim could be substantial. More self-driving cars are likely to

appear on the roads, increasing the risk of a collision with one. As a result,

drivers may need to consider purchasing more insurance than the minimum

required by their states.

- Drivers Can Still Face Liability – If you’re injured by the driver of an autonomous vehicle, but the technology didn’t play a role in the accident, you will still be able to collect damages from that driver. Owning and operating a driverless car may, therefore, impact the type of insurance you will need. With autonomous cars being new, one cannot assume a malfunctioning autopilot will always be the cause of an accident.

Apply for Pre-Settlement Funding with Lawsuit Cash 24/7

Whether your motor vehicle accident was caused by a self-driving car or not, apply for legal funding in Los Angeles today. With Lawsuit Cash 24/7, we offer an easy, hassle-free application process. All funding is non-recourse; pay nothing back if your case doesn’t win.

Get a car accident lawsuit advance to cover your medical expenses, rent, household bills, and more while your case or settlement is pending. Lawsuit Cash 24/7 can approve you for car accident funding in less than 24 hours, with no hidden fees — apply nowor call toll-free at (866) 321-7720 today!

Recent Comments